How China's taking over Africa

and why the

West should be VERY worriedBy Andrew Malone

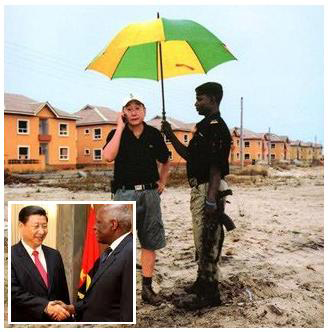

In the greatest movement of people the world has ever seen, China is secretly working to turn the entire African continent into a new colony.

Reminiscent of the West's imperial push in the 18th and 19th centuries - but on a much more dramatic, determined scale - China's rulers believe Africa can become a 'satellite' state, solving its own problems of over-population and shortage of natural resources at a stroke.

With little fanfare, a staggering 750,000 Chinese have settled in Africa over the past decade. More are on the way.

The strategy has been carefully devised by officials in Beijing, where one expert has estimated that China will eventually need to send 300 million people to Africa to solve the problems of over-population and pollution.

The plans appear on track. Across Africa, the red flag of China is flying. Lucrative deals are being struck to buy its commodities - oil, platinum, gold and minerals. New embassies and air routes are opening up. The continent's new Chinese elite can be seen everywhere, shopping at their own expensive boutiques, driving Mercedes and BMW limousines, sending their children to exclusive private schools.

The pot-holed roads are cluttered with Chinese buses, taking people to markets filled with cheap Chinese goods. More than a thousand miles of new Chinese railroads are crisscrossing the continent, carrying billions of tons of illegally-logged timber, diamonds and gold.

The trains are linked to ports dotted around the coast, waiting to carry the goods back to Beijing after unloading cargoes of cheap toys made in China.

Confucius Institutes (state-funded Chinese 'cultural centres') have sprung up throughout Africa, as far afield as the tiny land-locked countries of Burundi and Rwanda, teaching baffled local people how to do business in Mandarin and Cantonese.

Massive dams are being built, flooding nature reserves. The land is scarred with giant Chinese mines, with 'slave' labourers paid less than £1 a day to extract ore and minerals.

Pristine forests are being destroyed, with China taking up to 70 per cent of all timber from Africa.

All over this great continent, the Chinese presence is swelling into a flood. Angola has its own 'Chinatown', as do great African cities such as Dar es Salaam and Nairobi.

Exclusive, gated compounds, serving only Chinese food, and where no blacks are allowed, are being built all over the continent. 'African cloths' sold in markets on the continent are now almost always imported, bearing the legend: 'Made in China'.

From Nigeria in the north, to Equatorial Guinea, Gabon and Angola in the west, across Chad and Sudan in the east, and south through Zambia, Zimbabwe and Mozambique, China has seized a vice-like grip on a continent which officials have decided is crucial to the superpower's long-term survival.

'The Chinese are all over the place,' says Trevor Ncube, a prominent African businessman with publishing interests around the continent. 'If the British were our masters yesterday, the Chinese have taken their place.'

Likened to one race deciding to adopt a new home on another planet, Beijing has launched its so-called 'One China In Africa' policy because of crippling pressure on its own natural resources in a country where the population has almost trebled from 500 million to 1.3 billion in 50 years.

China is hungry - for land, food and energy. While accounting for a fifth of the world's population, its oil consumption has risen 35-fold in the past decade and Africa is now providing a third of it; imports of steel, copper and aluminium have also shot up, with Beijing devouring 80 per cent of world supplies.

Fuelling its own boom at home, China is also desperate for new markets to sell goods. And Africa, with non-existent health and safety rules to protect against shoddy and dangerous goods, is the perfect destination.

The result of China's demand for raw materials and its sales of products to Africa is that turnover in trade between Africa and China has risen from £5million annually a decade ago to £6billion today.

However, there is a lethal price to pay. There is a sinister aspect to this invasion. Chinese-made war planes roar through the African sky, bombing opponents. Chinese-made assault rifles and grenades are being used to fuel countless murderous civil wars, often over the materials the Chinese are desperate to buy.

The Fear and the Communist Chinese Invasion of Africa

Take, for example, Zimbabwe. Recently, a giant container ship from China was due to deliver its cargo of three million rounds of AK-47 ammunition, 3,000 rocket-propelled grenades and 1,500 mortars to President Robert Mugabe's regime.

After an international outcry, the vessel, the An Yue Jiang, was forced to return to China, despite Beijing's insistence that the arms consignment was a 'normal commercial deal'.

Indeed, the 77-ton arms shipment would have been small beer - a fraction of China's help to Mugabe. He already has high-tech, Chinese-built helicopter gunships and fighter jets to use against his people.

Ever since the U.S. and Britain imposed sanctions in 2003, Mugabe has courted the Chinese, offering mining concessions for arms and currency.

While flying regularly to Beijing as a high-ranking guest, the 84-year-old dictator rants at 'small dots' such as Britain and America.

He can afford to. Mugabe is orchestrating his campaign of terror from a 25-bedroom, pagoda-style mansion built by the Chinese. Much of his estimated £1billion fortune is believed to have been siphoned off from Chinese 'loans'.

The imposing grey building of ZANU-PF, his ruling party, was paid for and built by the Chinese. Mugabe received £200 million last year alone from China, enabling him to buy loyalty from the army.

In another disturbing illustration of the warm relations between China and the ageing dictator, a platoon of the China People's Liberation Army has been out on the streets of Mutare, a city near the border with Mozambique, which voted against the president in the recent, disputed election.

Almost 30 years ago, Britain pulled out of Zimbabwe - as it had done already out of the rest of Africa, in the wake of Harold Macmillan's 'wind of change' speech. Today, Mugabe says: 'We have turned East, where the sun rises, and given our backs to the West, where the sun sets.'

Despite Britain's commendable colonial legacy of a network of roads, railways and schools, the British are now being shunned.

According to one veteran diplomat: 'China is easier to do business with because it doesn't care about human rights in Africa - just as it doesn't care about them in its own country. All the Chinese care about is money.'

Nowhere is that more true than Sudan. Branded 'Africa's Killing Fields', the massive oil-rich East African state is in the throes of the genocide and slaughter of hundreds of thousands of black, non-Arab peasants in southern Sudan.

In effect, through its supplies of arms and support, China has been accused of underwriting a humanitarian scandal. The atrocities in Sudan have been described by the U.S. as 'the worst human rights crisis in the world today'.

The government in Khartoum has helped the feared Janjaweed militia to rape, murder and burn to death more than 350,000 people.

The Chinese - who now buy half of all Sudan's oil - have happily provided armoured vehicles, aircraft and millions of bullets and grenades in return for lucrative deals. Indeed, an estimated £1billion of Chinese cash has been spent on weapons.

According to Human Rights First, a leading human rights advocacy organisation, Chinese-made AK-47 assault rifles, grenade launchers and ammunition for rifles and heavy machine guns are continuing to flow into Darfur, which is dotted with giant refugee camps, each containing hundreds of thousands of people.

Between 2003 and 2006, China sold Sudan $55 million worth of small arms, flouting a United Nations weapons embargo.

With new warnings that the cycle of killing is intensifying, an estimated two thirds of the non-Arab population has lost at least one member of their families in Darfur.

Although two million people have been uprooted from their homes in the conflict, China has repeatedly thwarted United Nations denunciations of the Sudanese regime.

While the Sudanese slaughter has attracted worldwide condemnation, prompting Hollywood film-maker Steven Spielberg to quit as artistic director of the Beijing Olympics, few parts of Africa are now untouched by China.

In Congo, more than £2billion has been 'loaned' to the government. In Angola, £3 billion has been paid in exchange for oil. In Nigeria, more than £5billion has been handed over.

In Equatorial Guinea, where the president publicly hung his predecessor from a cage suspended in a theatre before having him shot, Chinese firms are helping the dictator build an entirely new capital, full of gleaming skyscrapers and, of course, Chinese restaurants.

After battling for years against the white colonial powers of Britain, France, Belgium and Germany, post-independence African leaders are happy to do business with China for a straightforward reason: cash.

With western loans linked to an insistence on democratic reforms and the need for 'transparency' in using the money (diplomatic language for rules to ensure dictators do not pocket millions), the Chinese have proved much more relaxed about what their billions are used for.

Certainly, little of it reaches the continent's impoverished 800 million people. Much of it goes straight into the pockets of dictators. In Africa, corruption is a multi-billion pound industry and many experts believe that China is fuelling the cancer.

The Chinese are contemptuous of such criticism. To them, Africa is about pragmatism, not human rights. 'Business is business,' says Chinese Deputy Foreign Minister Zhou Wenzhong, adding that Beijing should not interfere in 'internal' affairs. 'We try to separate politics from business.'

While the bounty has, not surprisingly, been welcomed by African dictators, the people of Africa are less impressed. At a market in Zimbabwe recently, where Chinese goods were on sale at nearly every stall, one woman told me she would not waste her money on 'Zing-Zong' products.

'They go Zing when they work, and then they quickly go Zong and break,' she said. 'They are a waste of money. But there's nothing else. China is the only country that will do business with us.'

There have also been riots in Zambia, Angola and Congo over the flood of Chinese immigrant workers. The Chinese do not use African labour where possible, saying black Africans are lazy and unskilled.

In Angola, the government has agreed that 70 per cent of tendered public works must go to Chinese firms, most of which do not employ Angolans.

As well as enticing hundreds of thousands to settle in Africa, they have even shipped Chinese prisoners to produce the goods cheaply.

In Kenya, for example, only ten textile factories are still producing, compared with 200 factories five years ago, as China undercuts locals in the production of 'African' souvenirs.

Where will it all end? As far as Beijing is concerned, it will stop only when Africa no longer has any minerals or oil to be extracted from the continent.

A century after Sir Francis Galton outlined his vision for Africa, the Chinese are here to stay. More will come.

The people of this bewitching, beautiful continent, where humankind first emerged from the Great Rift Valley, desperately need progress. The Chinese are not here for that.

They are here for plunder. After centuries of pain and war, Africa deserves better.

Where will it end?

One Chinese expert was so bold as to suggest that China needed eventually to send 300 million people to Africa to solve its problems of over-population and pollution. What Africans think of the idea is another matter. But they may have no choice as African country after country succumbs to Chinese advances.

Child Slave Labour Camps in Angola

16 December 2010

Local villagers report to Voice of America that 200 underage children work in forced labor camps 15 hours per day in Communist Chinese run rice fields guarded under the eye of Presidential Armed Guard personnel. This children where kidnapped by the MPLA Regime in the provinces of Benguela, Kwanza-Sul and Huila, without access to any medical assistance.

The China Option, the China Problem, The China Fear

By Derek Catsam7 December 2010

It might be one of the most dramatic changes in Africa in the last decade or so, and it’s crept in so quickly that it is hard to identify when it all happened. Go to Gabarone or Lusaka or Windhoek and you see a new construction project. Look closely. The odds are pretty good that you’ll see Chinese characters on the signs and Chinese workers all over the site.

Neocolonialism on the part of the Chinese? Savvy brokering of east versus west on the part of Africans? Unintended consequence of globalization? Or potentially any of these or all of these depending on the circumstance?

A recent story in the New York Times revealed the tensions between African workers and the Chinese management operating coal mines in Zambia. Naturally there are likely to be tensions between Chinese investors serving one master and Africans with very different interests. Investment rarely comes without the potential for tension.

And yet the only thing that Africans might fear more than the encroaching power of Chinese investors is the possibility that those investors will disappear. One of the many, many discoveries from the Wikileaks documents is revelations of concerns from Kenya that Africa will suffer from agreements between the United States and China. Tellingly, the biggest concern seems to be that the Americans will try to manage Chinese involvement in Africa in ways that would lead to less bilateral cooperation. (Kenya also was stung in Wikileaks when one of the American cables referred to the country as a “swamp of graft.”)

This could very well to prove to be the defining paradigm of African relations with the world. Ideally African states and private interests would be able to play Chinese and American interests off one another to broker the best deals. But that requires certain conditions. Africans rightfully don’t entirely trust the West. It remains to be seen if they ought to place faith in the power in the East.

Villagers Su Bairen, 69, and Yan Man Jia Hong, 74, stand on the edge of the six-mile-wide toxic lake in Baotou, China that has devastated their farmland and ruined the health of the people in their community. Africa is next to be destroyed by the Communist Chinese Regime.

Bienvenue en China-Afrique

Par Katia CLARENS

February 2011

À Brazzaville comme un peu partout en Afrique, les Chinois raflent tous les gros contrats d'infrastructures. Avec la bénédiction des gouvernements, ils s'enracinent sur le continent noir.

"Pan Chinois" ou encore "Cheng Chong de Chine", peut-on lire sur les devantures des échoppes où s'amoncellent biberons, parapluies, plaques chauffantes et baskets.

Plus chic, le supermarché Asia offre toute une palette de nouilles, de sauces, de produits de beauté, en plein centre de Brazzaville.

Au Yes Club, on sert une cuisine chinoise dans un décor raffiné. L'endroit appartient à Jessica Yé, une femme d'affaires qui vit, comme son époux, en République du Congo depuis plus de dix ans. Ils font partie des pionniers chinois. "Lorsque je suis arrivé en 1998, il n'y avait pas plus de 60 Chinois au Congo", raconte Philippe Zhang, le mari de Jessica.

La présence chinoise s'est affirmée en une décennie, portée par le succès des entreprises de travaux publics. Arrivées avec des tarifs inégalables, elles décrochent désormais la quasi-totalité des grands chantiers: routes, ministères, lotissements, etc.

La plus puissante est la Société Zhengwei Technique Congo (SZTC), filiale de la multinationale Weihai International (WIETC). Ses camions sillonnent Brazzaville en vibrant de toute leur masse sur les routes déglinguées, acheminant des matériaux de construction vers des dizaines de chantiers.

Le plus impressionnant est celui du nouvel aéroport. Passé le portail, s'élèvent de labyrinthiques échafaudages de fer rouillé dans lesquels s'affairent des ouvriers congolais casqués et supervisés par des chefs d'équipe chinois. Le premier terminal est achevé. On bâtit désormais la route aérienne qui y conduira, ainsi qu'un hôtel de luxe pour la clientèle d'affaires.

Tout proche, le site principal de WIETC regroupe les bureaux de la direction et les logements de ses travailleurs expatriés. On dirait une caserne, avec sa succession de longs bâtiments identiques protégés par une enceinte de béton coiffée de barbelés, au-dessus desquels flottent les drapeaux chinois et congolais. Dans le quartier de Diata, la firme achève la construction d'un complexe sportif et de la grande bibliothèque de l'université Marien NGOUABI.

Les Chinois seraient plus de 10.000 dans le pays, majoritairement employés par les entreprises gouvernementales. Le Congo est un partenaire dévoué de la Chinafrique.

"Nous souhaitons que la Chine augmente ses investissements en République du Congo et nous allons accorder des politiques préférentielles", déclarait en décembre, le ministre congolais des Transports, de l'Aviation civile et de la Marine marchande, en visite à Pékin.

À Brazzaville, les délégations se succèdent. Les dirigeants d'Avic International, un constructeur naval, ont atterri le 19 janvier 2011 ; ils viennent proposer leurs pétroliers, chimiquiers et porte-conteneurs.

Au Yes Club de Brazzaville, un groupe d'ingénieurs du département de développement des affaires internationales d'un géant chinois de la construction est attablé.

Ils sont en visite, disent-ils, afin d'identifier les opportunités. Comptent-ils rencontrer les autorités du pays ? "Non, personne... Nous sommes juste venus pour visiter", répètent-ils, visiblement gênés.

Quelques minutes plus tard, un Congolais portant un costume de bonne facture, accompagné de ce qui semble être son homme de main, s'installe dans le salon du restaurant, immédiatement rejoint par le groupe.

S'agit-il d'un conseiller de la délégation générale des grands travaux, rattachée à la présidence et unique interlocuteur en matière de travaux publics? Mystère. "La plupart des chantiers sont attribués arbitrairement, explique-t-on sous couvert d'anonymat. Les appels d'offres sont un décorum".

Les gouvernements et les puissances influentes se succèdent en Afrique. La corruption reste. Sur le continent, où vit aujourd'hui un demi-million de Chinois, selon Serge MICHEL, les entreprises de l'empire du Milieu n'ont pas bonne presse. Elles sous-payent leurs employés, ne respectent pas les règles de sécurité et dégradent l'environnement. Mais elles bâtissent les pays.

En République démocratique du Congo (RDC), sur l'autre rive du fleuve, elles ont négocié des échanges "minerais contre constructions". Hôpitaux, routes, rail, accès à l'eau et à l'électricité, elles aménagent la RDC, contribuant à la gloire du président Joseph Kabila qui leur doit ses "Cinq chantiers du cinquantenaire".

Pour les porter plus haut encore, une génération plus moderne d'entrepreneurs est en train d'éclore, messagère d'une nouvelle politique commerciale. Zhou Yong, directeur général du département de développement d'affaires de la Corporation des Routes et Ponts de Chine (CRBC), est à Brazzaville pour quelques jours.

Il plaide pour de nouveaux partenariats, avec les entreprises françaises notamment. "La première chose que nous voulons apprendre des entreprises françaises, explique M. Zhou, pragmatique, c'est leur fonctionnement. Nos entreprises reposent sur un directeur général qui décide de tout. Cela comporte trop de possibilités d'erreur humaine. La deuxième chose intéressante est qu'avec les entreprises françaises, nous pourrons entrer plus profondément dans le pays. Vos grands groupes, comme Bolloré ou Total, vivent ici depuis des années. Les Chinois se heurtent au problème de la langue et à celui des coutumes. Cela freine notre expansion".

Il y a deux ans, le Premier ministre François FILLON avait participé à un forum organisé par l'ambassade de France à Pékin. Objectif : développer la coopération entre entreprises françaises et chinoises, notamment en Afrique. Une deuxième édition est prévue cette année.

Labour Abuses in Zambia's Chinese State-owned Copper Mines

"You’ll Be Fired if You Refuse"

November 3, 2011This 122-page report details the persistent abuses in Chinese-run mines, including poor health and safety conditions, regular 12-hour and even 18-hour shifts involving arduous labor, and anti-union activities, all in violation of Zambia’s national laws or international labor standards. The four Chinese-run copper mining companies in Zambia are subsidiaries of China Non-Ferrous Metals Mining Corporation, a state-owned enterprise under the authority of China’s highest executive body. Copper mining is the lifeblood of the Zambian economy, contributing nearly 75 percent of the country’s exports and two-thirds of the central government revenue.

Download the full report (PDF, 1.05 MB)

African Safari: CIF's Grab for Oil and Minerals

A mysterious company introduces a new model for doing business in Africa

10.17.2011

Editor’s Note

Africa has become one of China’s most important energy sources. Nowhere on the continent is this more evident than in Angola, China’s second-largest oil supplier, trailing only Saudi Arabia.

According to Chinese customs data, Angola’s oil exports to China increased to 40 million tons last year from 16.2 million tons in 2004. China’s state-run oil companies, mainly Sinopec Group, have won a number of drilling concessions. The country’s oil fields now account for 16 percent of all foreign crude shipped to Chinese refineries.

In exchange, China writes loans and builds infrastructure. Chinese enterprises have undertaken infrastructure projects ranging from highways and railroads, to airports and public housing. Non-Chinese media outlets say about 70,000 Chinese laborers have worked at Angolan construction sites.

Lubricating deals between China and Angola is a small group of deal brokers headed by Hong Kong-based Sam Pa and Lo Fong Hung. They’re at the core of concerns called China International Fund (CIF) and China Sonangol, CIF’s joint venture with Angola’s state oil company Sonangol. In these capacities, they’ve demonstrated unparalleled power.

CIF’s activities have attracted critical attention from various researchers. In 2009, British foreign policy think tank Chatham House and the U.S.-China Economic & Security Review Commission began in-depth studies of the Pa and Lo’s dealings to clarify CIF’s mysterious background and vast influence. An August 2010 report in the Economist magazine gave the CIF-Angola connection wide exposure.

Reporters at Columbia University’s Toni Stabile Centre for Investigative Journalism started looking into CIF and its various business ventures around the world last year. They recently completed the probe, and the center has given Caixin exclusive permission to publish the investigative team’s just-completed report in this edition.

Meanwhile, Caixin reporters conducted and completed a parallel probe in Beijing and Hong Kong that traced CIF’s controversial activities in Angola, as well as its links to the Chinese government. Portions of this report, which likewise appears in this edition, were based on a previously undisclosed Ministry of Commerce study with surprising conclusions.

He was an outgoing Hong Kong businessman with a toothbrush moustache, multiple aliases, and his friends say, a fondness for women and fast cars. She was an older Chinese matron who liked to tell friends and business associates that she was once Deng Xiaoping's translator.

Eight years ago, the two of them formed a business to sell oil and minerals to China. It didn't matter that Sam Pa and his partner Lo Fong Hung had little money and no experience in the oil business. They had good timing and high-level connections.

When they formed the China International Fund (CIF) in Hong Kong in 2003, China had just begun looking toward Africa as a source of oil. At the same time, oil-rich Angola had just emerged from 27 years of civil war and desperately needed to rebuild its devastated infrastructure. The International Monetary Fund, however, was reluctant to lend money unless Sonangol, the national oil company, cleaned up its accounts, published its audit reports and the government cracked down on corruption. A 2006 IMF report cited concerns regarding Sonangol's "deep-rooted governance and corruption issues."

In 2005, CIF announced a US$ 2.9 billion line of credit to rebuild infrastructure in Angola. The same year, China Sonangol, CIF's Hong Kong-registered joint venture with Sonangol, became the broker of oil sales to China from Angola, which has since become China's No. 1 source of oil.

In the years that followed, the CIF network acquired shares in a dozen Angolan oil blocks and diamond concessions in Zimbabwe. It also got a lucrative mining contract in Guinea, which has the world's richest iron ore and bauxite deposits.

In 2008, it took over what was once the most famous address in American finance: 23 Wall Street, the headquarters of the world's first billion-dollar corporation, JP Morgan Co.

Today CIF is the center of a transnational network of over 60 interlocking companies in the investor friendly regimes of Singapore and Hong Kong and the offshore havens of Bermuda, the British Virgin Islands and the Cayman Islands.

CIF has introduced a new model for doing business in Africa: A private Hong Kong company would provide loans from Chinese government banks to help resource-rich African countries build their infrastructure. In exchange, it would get oil and minerals to sell to China.

Flying around Africa

Over the past few years, Pa and Lo have flown around Africa on a luxury jet, promising some US$ 18 billion worth of infrastructure to Angola, Zimbabawe, Guinea and Madagascar.

But there was a catch. CIF and its affiliated companies ended up with rights to explore, and in some cases, exploit some of Africa's richest mineral resources - but much of the promised infrastructure never materialized. The proceeds of those mineral transactions were then invested by CIF's companies in places far from the reach of African law and the scrutiny of citizens of the affected states.

In Angola, CIF pledged to work on three railway projects, build a new international airport and construct over 200,000 units of social housing. But problems soon arose.

The airport, meant to be the flagship of CIF's assistance and projected to be the biggest in Africa, remains unfinished over five years after it was first announced. Angolan investigative journalist Rafael Marques de Morais reported in March that little more than a partial foundation had been built. Contacted by email last week, Marques said that not much has changed since.

CIF went into countries when the regimes in power were particularly vulnerable and facing international condemnation: in Guinea in 2008, after an army captain had ousted the government; in Zimbabwe, as President Robert Mugabe struggled to stay in power in 2009; and in Madagascar in 2010, just weeks after a military coup.

In each of them, CIF set up a "development corporation" registered in Hong Kong or Singapore, which would be a joint venture between China Sonangol and the government concerned. The new corporation would get mining rights in those countries and also manage infrastructure projects to be funded by loans from China Sonangol.

CIF's deals have raised eyebrows in the boardrooms of oil and mining firms and among watchdogs monitoring natural-resource companies in the developing world.

"This is the new face of competition for natural resources," said Judith Poultney an analyst at the international corruption watchdog Global Witness, which has looked into CIF and other natural-resource deals in Africa. "African elites are using complex offshore structures to cut themselves a personal slice of resource deals with Asian entrepreneurs. And like the old scramble for Africa by the West, it is the ordinary African citizen who loses out."

Relationship with China

Throughout its history, CIF's relationship with the Chinese government has been the subject of speculation. The connections of CIF executives and their high-profile meetings with African officials gave the impression that they had official backing from the Chinese government. But there is no official connection. The Ministry of Foreign Affairs has repeatedly distanced itself from CIF's activities, going so far as to issue a press statement in 2009 saying that CIF is a private company with no connection to the Chinese government.

CIF has gotten loans from state-owned Bank of China and it sold oil to a subsidiary of Sinopec. A 2006 China Sonangol mortgage filing in Hong Kong says it owns 45 percent of Sonangol Sinopec International (SSI), a joint venture with Sinopec.

In 2004, SSI was awarded a 50 percent share of Oil Block 18, making it the first Chinese company to own shares of an oil block in Angola, where oil exploration has traditionally been dominated by Western firms.

SSI made headlines two years later during a record-breaking round of bidding for Angolan oil blocks. Sonangol's 2011 concession map shows that between them, China Sonangol and SSI have concessions in eight Angolan oil blocks. In March, the Economist Intelligence Unit reported that China Sonangol purchased 10 to 15 percent shares in four more oil concessions.

From 2005 to 2008, China Sonangol also bought Angolan oil and then sold at least 15 million barrels every year to a subsidiary of Sinopec.

Mortgage documents filed in Hong Kong by China Sonangol show the sales agreements were used to secure a US$ 2 billion loan to Sonangol from a consortium of banks. In 2006, the Bank of China issued loans to CIF and another affiliated company that were secured with the oil contracts, the documents said.

CIF'S Connections

On April 4, 2004, Sam Pa and Lo Fong Hung were guests on "Alo Presidente," a TV program hosted by Venezuelan President Hugo Chavez. During the program, Chavez sung Lo's praises, "She has such charisma," he said, adding that she is the "daughter of a Chinese general, someone who comes from a family with a military tradition and who is now the manager of a global company."

Lo is married to Wang Xiangfei, who holds several directorships in some influential Chinese state-owned companies. He is currently on the board of several CIF-linked companies.

Before CIF, Lo formed just one Hong Kong company, Deltop Limited. In 2003, she helped set up CIF's parent company, New Bright International. Today she is the director of over 60 CIF-linked companies worldwide.

Sam Pa was originally from Hong Kong, where in the 1980s, he formed several companies under the name Ghiu Ka Leung. One of the companies listed his address as a building near Tiananmen Square, which during that period housed the Belgian embassy.

A former business associate in Hong Kong says that in the 1980s, Pa headed a company that traded equipment with China. In the 1990s, he tried his hand doing business in Hun Sen's Cambodia, but fell into debt, said the associate.

In the 1990s and the early part of the 2000s, Pa was sued over 15 times for bankruptcy, unpaid debts and tax delinquency, according to Hong Kong court records.

After Cambodia, Pa was in Macau where, according to a long-time friend in Hong Kong, he was introduced to the Portuguese banking and business community on the island. By 2004, Pa had entered into a partnership with the Angola-based Portuguese banker Helder Bataglia, who founded the Escom Group, an oil, mining and real estate conglomerate that does business in Angola and Congo.

In the spring of that year, he joined Bataglia on a business trip to meet with President Chavez in Caracas. During that trip, Chavez announced in a public broadcast that Bataglia's Escom and CIF's parent company, Beiya International Development, were working together on projects including "mobile, national television, satellite television station and the construction of social housing" in Venezuela. This partnership, however, fell through.

Pa's girlfriend, Veronica Fung, is listed as the owner of 70 percent of New Bright International, a Hong Kong company formed in 2003 that sits at the top of the CIF corporate structure. She is also a director of 23 other CIF-related firms.

In 2003, the Beiya International Development Company was formed: 70 percent was owned by New Bright and 30 percent, by Beiya Industrial Group, a railway construction company based in Harbin. Beiya, later renamed the Dayuan International Development Corporation, owns 99 percent of the China International Fund.

Multiple attempts to reach Pa and CIF's directors over the phone and through email have gone unanswered since July. One of our reporters went to see them at CIF's Hong Kong offices in July but she was turned away. She was also refused access to any CIF officer by the company's Hong Kong lawyer. Court records show that Pa uses several aliases, among them Sam King and Ghiu Ka Leung. Calls to CIF offices in Hong Kong requesting to speak to these people were never returned.

Expanding in Africa

CIF's Angolan connection eased its entry into Guinea and later, Madagscar and Zimbabwe.

In 2008, dissident army officers ousted the Guinean government. The new regime was diplomatically isolated and desperate for cash. When CIF approached Mahmoud Thiam, an investment banker who was then Guinea's mining minister, he was initially skeptical of their offer to provide much-needed financial support as a "special friend."

"When a new government comes into power, especially an inexperienced one," he said in an interview in New York, "there's one phenomenon that never fails: every crook on Earth shows up. And every crook on Earth has the biggest promises, has access to billions of dollars of lines of credits, of loans." A week later, he says, CIF arranged for Sonangol's powerful CEO and President Eduardo Dos Santos's heir apparent, Manuel Vicente, to fly to Conakry to convince him.

Within six months, Thiam had signed what he called the "contract of the century." In a press conference on October 10, 2009, he announced that CIF would be investing from US$ 7-9 billion in Guinea. CIF was given rights to explore three large areas of Guinea in return for infrastructure projects proposed by the government.

The signing ceremony came 12 days after one of the bloodiest events in recent Guinean history. On September 28, the Guinean military opened fire on a peaceful protest against the junta, leaving over 150 people dead. Hundreds of women were raped and 1,200 protesters were injured. The international community reacted by imposing sanctions.

"There was something seriously wrong," said Abdoulaye Yero Baldé, current vice-governor of the Guinean Central Bank who was then in the opposition. "The government had just raped women and killed innocent civilians, all investors were going away and yet this group stayed and signed. It's hard to know what's truly in it for Guinea in this contract."

One month after the massacre, CIF transferred US$ 100 million from a Bank of China account in Hong Kong to the Guinean Central Bank as an advance on the infrastructure projects they had promised. Thiam said in an interview that he had requested use of US$ 50 million for "emergency budgetary support" because the government was then short on cash.

On October 21, 2009, CIF lent the Guinean government US$ 3.3 million to audit a rival Russian company, Rusal, the world's largest aluminum firm, which had mining concessions that China Sonangol was interested in acquiring. The loan agreement specified that CIF would receive 1.8% of the money recovered from Rusal by the Guinean government and was signed by Thiam. When asked about the reason for obtaining funding from China Sonangol for the audit, Thiam said "it was the only place where we could get that money."

In a February 26, 2010 cable recently released by Wikileaks, the U.S. embassy in Conakry reported that its political chief had met with executives of Western mining companies operating in Guinea. The cable reported that at the meeting, the country representative of the Australian mining company, Rio Tinto, said that Thiam "personally benefited from promoting CIF" and worked closely with the president "to ensure that deals that provide kickbacks to the leader and his CNDD compatriots are assured throughout the transition."

When asked to comment on the allegations, Thiam said, "The ambassador quotes the directors of mining companies against which I was fighting to reestablish and enforce Guinea's rights. These are the opinions of desperados."

In December 2010, Thiam flew to Madagascar with CIF representatives to negotiate with the Malagasy government, which came to power after a March 2009 coup. He was a friend of the mining minister, and CIF was interested in the country's Tsimoro oil block, which is estimated to have 975 million barrels of oil reserves.

The company's entry into Madagascar was soon followed by a government-sanctioned audit of Madagascar Oil, a Texas-based firm that until recently had stakes in the Tsimoro oil block. Gide Loyrette Nouel, the same firm that audited another China Sonangol rival in Guinea, conducted the first round of audits. A second audit quickly followed, conducted by representatives of one of Sinopec's subsidiaries.

In January this year, the finance minister announced the formation of the Madagascar Development Corp. (MDC), a joint venture between the government and CIF. Registered in Singapore, it is to have priority over all other companies in the exploration of the country's oil and minerals.

That venture, however, appears to be at a standstill. Although the company has workers on the ground, nothing has been built.

In Guinea, meanwhile, CIF's relationship with the democratically elected government that came to power last year seems uncertain. Last month, Reuters quoted the new mining minister as saying that the CIF contract had been overturned. Yet, during a visit to Columbia University in New York not long afterward, Guinean President Alpha Conde said, "I don't see how we can overturn the contract when we haven't examined it yet."

In Zimbabwe, China Sonangol and CIF followed the template they used in Guinea and Madagascar. They promised to help in the "refurbishment of the country's infrastructure" at a time when Zimbabwe was crumbling under the combined weight of factional politics, hyperinflation and a cholera epidemic that had already killed 4,000 people. CIF agreed to invest in gold and platinum refining, oil and gas exploration, fuel and housing development. Like elsewhere, however, few details of its agreement with the Mugabe government have been released.

CIF also formed a joint-venture, the Sino-Zim Development Corp. (SZDC), which was registered in Singapore. Singapore records reveal that SZDC is wholly owned by two companies registered in the British Virgin Islands. Another company also called Sino-Zim Development was registered in Zimbabwe. Lo and Pa's girlfriend Veronica Fung, are among its directors.

Sino Zim Development has concessions in the controversial Marange fields, where, according to Global Witness, "Zanu PF political and military elite are seeking to capture the country's diamond wealth through a combination of state-sponsored violence and the legally questionable introduction of opaque joint venture companies."

Buying Manhattan

CIF's global ambitions were soon evident in New York. In late 2008, China Sonangol purchased the JP Morgan Building from Africa Israel USA for US$ 150 million. It was considerably more than the building was worth at that time, according to a former Africa Israel executive. And China Sonangol, he said, bought the property sight unseen.

Months later, CIF was negotiating on another iconic building: the old New York Times office near Times Square.

Africa Israel USA, a real estate company owned by Uzbeki-Israeli diamond dealer Lev Leviev purchased the building for US$ 525 million in 2007. It was a much publicized sale, as Leviev had paid triple the price at which its previous owner had bought the building in 2004.

Leviev, who was already doing business in Angola, wanted China Sonangol to provide an additional US$ 25 million that he needed to fix up the property.

In 2009, a team from Africa Israel flew to Hong Kong to negotiate with China Sonangol representatives. The two-day meeting commenced with dinner on the 55th floor of a hotel. A businessman who was there said Lo Fung Hung donned a tiara and Sam Pa was dressed in cheap-looking pants and an open collar shirt. The CIF executives, he recounted, were discussing the Times deal while reaching over the multiple cell phones arranged in rows next to their plates and grabbing dinner rolls.

"They're all dressed like street people," recalls a former Africa Israel executive present during the negotiations. "One of them's got a diamond tiara on and the next one's wearing bag lady clothes. It just didn't look professional."

The following day, China Sonangol's representatives met with Leviev and Sam Pa signed a commitment letter to give the company US$ 25 million. But the agreement was never honored.

"The letter may as well have been signed on toilet paper," said the executive.

with additional reporting in Guinea by Patrick Martin-Menard, in Guinea and Hong Kong by Pei Shan Hoe, and in New York by members of the Stabile class of 2011, Graduate School of Journalism, Columbia University

FFSAFederation of the Free States of AfricaContactSecretary General

Mangovo Ngoyo

Email: [email protected]www.africafederation.net